tracking the cash coming in and out of the company’s operations. The shortcomings regarding the income statement (and accrual accounting) are addressed here by the CFS, which identifies the cash inflows and outflows over a certain time span while utilizing cash accounting – i.e. Ending Cash Balance = Beginning Cash Balance + Net Change in Cash.Subsequently, the net change in cash amount will then be added to the beginning-of-period cash balance to calculate the end-of-period cash balance. Net Change in Cash = Cash from Operations + Cash from Investing + Cash from Financing.If the three sections are added together, we arrive at the “Net Change in Cash” for the period. buybacks), repayments of financial obligations, and issuances of dividends are taken into account. Cash from Financing – In the final section, the net cash impact of raising capital from issuing equity or debt from outside investors, share repurchases (i.e.capital expenditures, as the major recurring outflow), followed by business acquisitions and divestitures. Cash from Investing – In the next section, investments are accounted for, with purchases of PP&E (i.e.Cash from Operations – The section’s top-line item is net income, which is adjusted by adding back non-cash expenses, such as D&A and stock-based compensation, and then adjusted for changes in working capital line items.

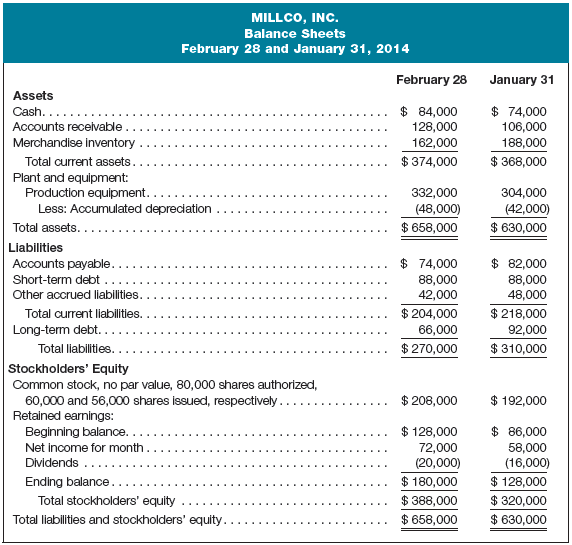

Under the indirect method, the cash flow statement is broken out into three distinct sections: Direct Method – Net income is not the starting point for this method, but rather, the direct method explicitly lists out the cash received and paid out to third parties during the period (e.g.depreciation & amortization) and changes in working capital to arrive at cash flow from operations. Indirect Method – In the U.S., the indirect method is far more common, whereby the starting line item is net income, which is adjusted for non-cash items (e.g.There are two methods by which CFS can be presented: Net income from the income statement flows in as the starting line item on the CFS, and the year-over-year changes in the balance sheet accounts are tracked on the CFS. In fact, a company with consistent net profits could potentially even go bankrupt.Īssuming the beginning and end of period balance sheets are available, the CFS could be put together (even if not explicitly provided) as long as the income statement is also available. Increase in NWC Liability and/or Decrease in NWC Asset ➝ Increase in Cash Flowįocusing on net income without looking at the real cash inflows and outflows can be misleading because accrual-basis profits are easier to manipulate than cash-basis profits.Increase in NWC Asset and/or Decrease in NWC Liability ➝ Decrease in Cash Flow.However, for changes in net working capital, the following rules apply:

The impact of non-cash add-backs is relatively straightforward, as these have a net positive impact on cash flows (e.g. In effect, the real movement of cash during the period in question is captured on the CFS – which brings attention to operational weaknesses and investments/financing activities that do not appear on the accrual-based income statement. Accounts Receivable (A/R), Inventory, Prepaid Expenses, Accounts Payable (A/P), Deferred Revenue, Accrued Expenses Depreciation & Amortization (D&A), Stock-Based Compensation Therefore, the CFS is necessary to reconcile net income to adjust for factors such as: the accrual-based “bottom line” – might not be an accurate depiction of what is actually occurring to the company’s cash. The net income as shown on the income statement – i.e.

0 kommentar(er)

0 kommentar(er)